Can You Write Off Scholarship Donations . The amount of charitable donations you can deduct may range from 20% to. — each group must register with the irs for the section of the law that applies to it. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. Religious and charitable organizations typically fall under. charity if the donation can be said to be in furtherance of its charitable objects. Tax deduction of donations is irrelevant to a. Donors are responsible for ensuring that the scholarship fund has.

from www.templateroller.com

charity if the donation can be said to be in furtherance of its charitable objects. Religious and charitable organizations typically fall under. — each group must register with the irs for the section of the law that applies to it. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. Tax deduction of donations is irrelevant to a. The amount of charitable donations you can deduct may range from 20% to. Donors are responsible for ensuring that the scholarship fund has.

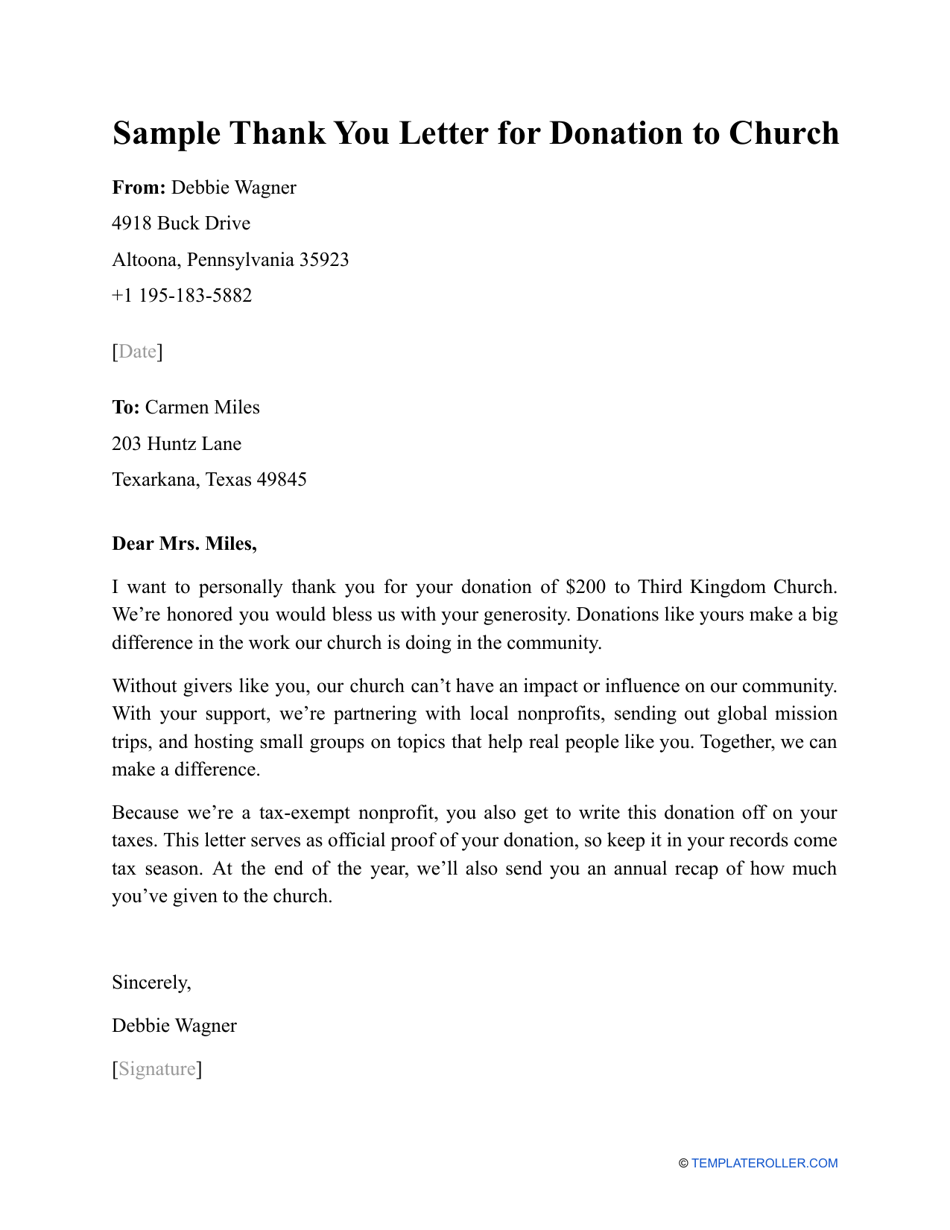

Sample Thank You Letter for Donation to Church Download Printable PDF

Can You Write Off Scholarship Donations Tax deduction of donations is irrelevant to a. Donors are responsible for ensuring that the scholarship fund has. Tax deduction of donations is irrelevant to a. The amount of charitable donations you can deduct may range from 20% to. charity if the donation can be said to be in furtherance of its charitable objects. — each group must register with the irs for the section of the law that applies to it. Religious and charitable organizations typically fall under. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to.

From www.etsy.com

Donation Request Letter Sponsorship Letter Donation Letter Fundraising Can You Write Off Scholarship Donations Donors are responsible for ensuring that the scholarship fund has. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. charity if the donation can be said to be in furtherance of its charitable objects. Religious and charitable organizations typically fall under. The amount of charitable donations. Can You Write Off Scholarship Donations.

From www.sampletemplatess.com

8+ Sample Donation Letter Template SampleTemplatess SampleTemplatess Can You Write Off Scholarship Donations The amount of charitable donations you can deduct may range from 20% to. Donors are responsible for ensuring that the scholarship fund has. — each group must register with the irs for the section of the law that applies to it. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season. Can You Write Off Scholarship Donations.

From utaheducationfacts.com

How To Write A Letter Asking For Donations Can You Write Off Scholarship Donations — each group must register with the irs for the section of the law that applies to it. Tax deduction of donations is irrelevant to a. The amount of charitable donations you can deduct may range from 20% to. Religious and charitable organizations typically fall under. charity if the donation can be said to be in furtherance of. Can You Write Off Scholarship Donations.

From www.vrogue.co

Donor Thank You Letter Sample Printable Pdf Download vrogue.co Can You Write Off Scholarship Donations Religious and charitable organizations typically fall under. Donors are responsible for ensuring that the scholarship fund has. Tax deduction of donations is irrelevant to a. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. — each group must register with the irs for the section of. Can You Write Off Scholarship Donations.

From student-tutor.com

How to Write a Winning Scholarship Essay in 10 Steps Can You Write Off Scholarship Donations Donors are responsible for ensuring that the scholarship fund has. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. Tax deduction of donations is irrelevant to a. — each group must register with the irs for the section of the law that applies to it. The. Can You Write Off Scholarship Donations.

From www.sampletemplates.com

FREE 7+ Sample Scholarship Essay Templates in PDF MS Word Can You Write Off Scholarship Donations enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. Donors are responsible for ensuring that the scholarship fund has. Tax deduction of donations is irrelevant to a. Religious and charitable organizations typically fall under. The amount of charitable donations you can deduct may range from 20% to.. Can You Write Off Scholarship Donations.

From www.doctemplates.net

12 Best Scholarship Thank you Letters [Sample Templates] Can You Write Off Scholarship Donations — each group must register with the irs for the section of the law that applies to it. Religious and charitable organizations typically fall under. charity if the donation can be said to be in furtherance of its charitable objects. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season. Can You Write Off Scholarship Donations.

From howtowritethesisstatement.blogspot.com

How to write a scholarship thank you letter examples scholly Union Can You Write Off Scholarship Donations Tax deduction of donations is irrelevant to a. Donors are responsible for ensuring that the scholarship fund has. The amount of charitable donations you can deduct may range from 20% to. — each group must register with the irs for the section of the law that applies to it. charity if the donation can be said to be. Can You Write Off Scholarship Donations.

From www.dexform.com

scholarship fund donation request letter in Word and Pdf formats Can You Write Off Scholarship Donations The amount of charitable donations you can deduct may range from 20% to. Religious and charitable organizations typically fall under. — each group must register with the irs for the section of the law that applies to it. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate. Can You Write Off Scholarship Donations.

From learningscalairy2.z21.web.core.windows.net

Sample Letter To Give A Donation Can You Write Off Scholarship Donations enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. Donors are responsible for ensuring that the scholarship fund has. The amount of charitable donations you can deduct may range from 20% to. Tax deduction of donations is irrelevant to a. — each group must register with. Can You Write Off Scholarship Donations.

From semioffice.com

Letter Requesting Scholarship Donations Can You Write Off Scholarship Donations charity if the donation can be said to be in furtherance of its charitable objects. Religious and charitable organizations typically fall under. — each group must register with the irs for the section of the law that applies to it. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season. Can You Write Off Scholarship Donations.

From dxoefbvmf.blob.core.windows.net

How To Ask For Gofundme Donations at Richard Ridgeway blog Can You Write Off Scholarship Donations Religious and charitable organizations typically fall under. Tax deduction of donations is irrelevant to a. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. The amount of charitable donations you can deduct may range from 20% to. — each group must register with the irs for. Can You Write Off Scholarship Donations.

From www.template.net

10+ Sample Donation ThankYou Letters DOC, PDF Can You Write Off Scholarship Donations charity if the donation can be said to be in furtherance of its charitable objects. Tax deduction of donations is irrelevant to a. — each group must register with the irs for the section of the law that applies to it. Religious and charitable organizations typically fall under. The amount of charitable donations you can deduct may range. Can You Write Off Scholarship Donations.

From onvacationswall.com

How Do You Write A Thank Letter For Scholarship Can You Write Off Scholarship Donations Donors are responsible for ensuring that the scholarship fund has. Religious and charitable organizations typically fall under. The amount of charitable donations you can deduct may range from 20% to. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. — each group must register with the. Can You Write Off Scholarship Donations.

From templates.rjuuc.edu.np

Scholarship Thank You Letter Template Can You Write Off Scholarship Donations Donors are responsible for ensuring that the scholarship fund has. Tax deduction of donations is irrelevant to a. — each group must register with the irs for the section of the law that applies to it. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. The. Can You Write Off Scholarship Donations.

From www.pinterest.com

sponsorship request letter sample letters thank you free word pdf Can You Write Off Scholarship Donations — each group must register with the irs for the section of the law that applies to it. Donors are responsible for ensuring that the scholarship fund has. charity if the donation can be said to be in furtherance of its charitable objects. Religious and charitable organizations typically fall under. The amount of charitable donations you can deduct. Can You Write Off Scholarship Donations.

From bestlettertemplate.com

13+ Free Donation Letter Template Format, Sample & Example Can You Write Off Scholarship Donations Donors are responsible for ensuring that the scholarship fund has. Tax deduction of donations is irrelevant to a. enjoy tax deductions of up to 2.5 times the qualifying donation amount during the next tax season when you donate to. — each group must register with the irs for the section of the law that applies to it. Religious. Can You Write Off Scholarship Donations.

From www.dexform.com

SAMPLE SCHOLARSHIP FUND DONATION REQUEST LETTER in Word and Pdf formats Can You Write Off Scholarship Donations — each group must register with the irs for the section of the law that applies to it. Donors are responsible for ensuring that the scholarship fund has. Tax deduction of donations is irrelevant to a. Religious and charitable organizations typically fall under. charity if the donation can be said to be in furtherance of its charitable objects.. Can You Write Off Scholarship Donations.